Last week Apple Inc (NASDAQ:AAPL) stock reached a one Trillion dollar valuation. A remarkable achievement. Of course there is nothing wrong with just buying the stock and holding it "forever". Today I would like to describe a different way to trade Apple using its options. It will also provide some insights into our trading process.

As most of our readers know, we trade non directional options strategies. That means that we don't care which direction the stock moves. Our strategies include mostly straddles, strangles and calendars around earnings.

This is how the process works:

WE RECOMMEND THE VIDEO: How To Use VfxAlert Signal On IQ Option - Binary Trading - Free Download 2020

This video discusses various tricks or strategies for trading, with various indicators and signals.

- Every week I post a list of trading candidates for the next week in Earnings Trades Discussions forum.

- I post a separate topic for each candidate I think it suitable, with analysis of the suggested prices, average move, previous cycle etc.

- The topic will always include a link to one of the relevant strategy topics above. This allows members to do their homework and to see if they like the potential trade.

- I will try to get the trade at the best possible price.

- When I do, I post it under the Trades forum.

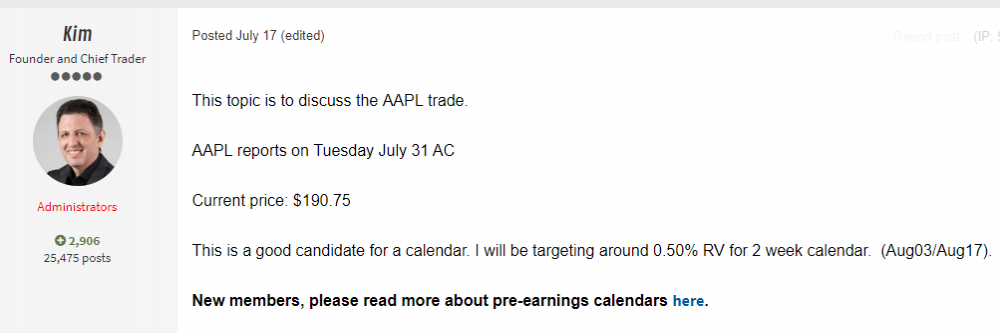

Apple was scheduled to report earnings on July 31. Two weeks before earnings, we noticed that AAPL pre earnings calendar looks cheap. A discussion topic has been opened (please note the discussion topic is always opened before the trade is placed):

This evaluation was based on proprietary software developed by one of our members. The software is designed to show the RV (Relative Value) of the strategies we trade in the last 8 cycles and compared them to the current cycle.

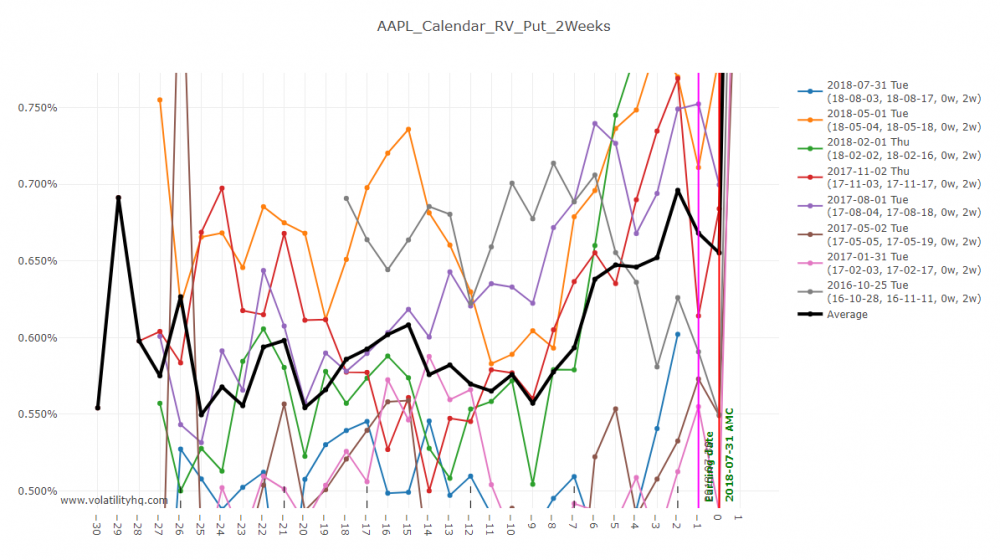

This is how it looked for AAPL:

The blue line is the RV in July 2017 cycle. The black line is the average of the previous 8 cycles. As you can see, the blue line was around 0.5% RV at T-10 (which is when the discussion topic was opened) while the black line had the potential to reach 0.65% RV or higher. That's 30%+ profit potential.

RV means "the price of the calendar as percentage of the stock price." With the stock price around $190, RV of 0.5% translates to $0.95 per spread.

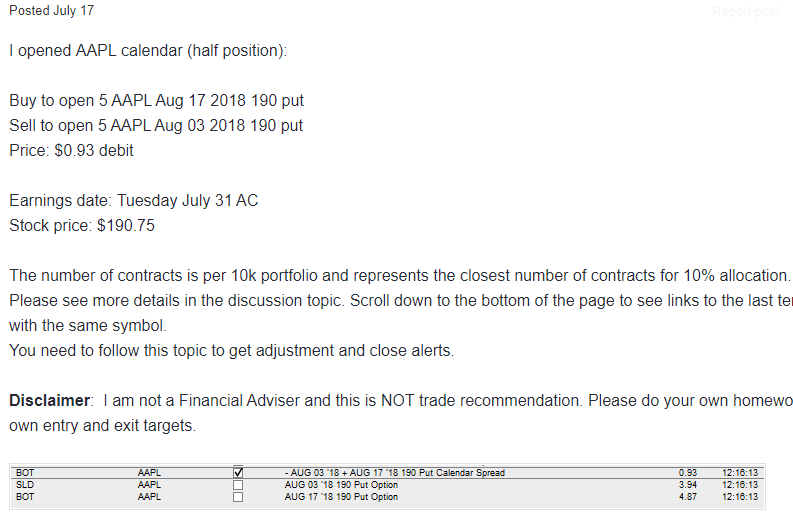

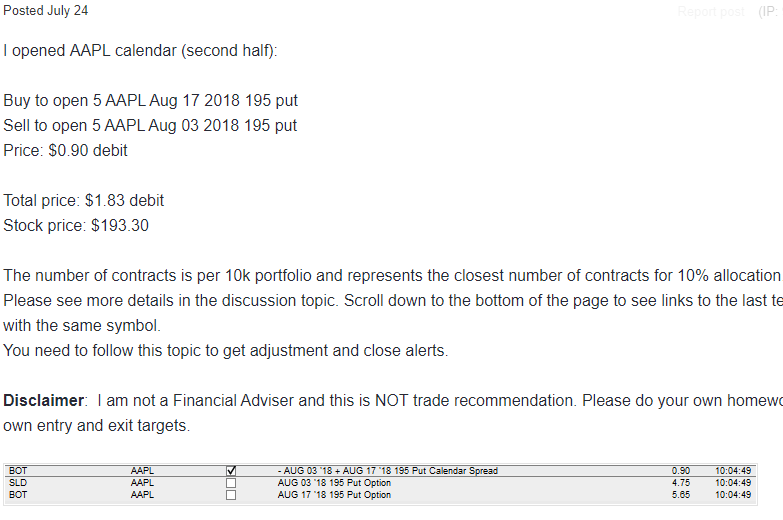

Based on the setup described in the discussion topic, the trade was opened later that day:

Please note that this was a half position (5 contracts, based on $10k model portfolio). We usually start with half position and open another half few days later.

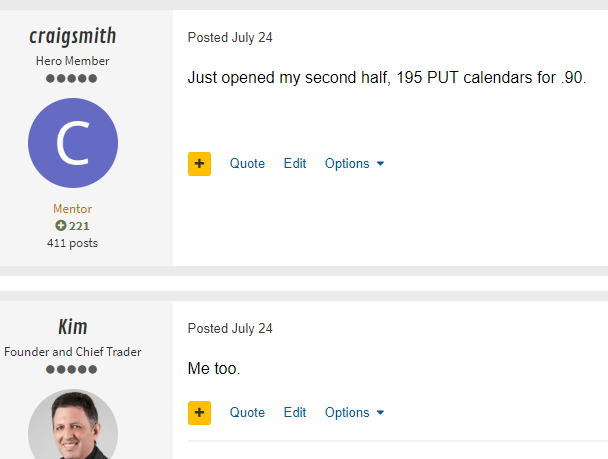

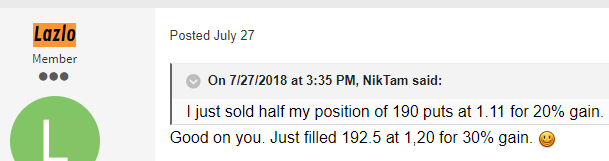

Some members actually got better prices the same day:

A week later when the stock moved to $193.30, we opened the second half of the trade:

It is interesting that some members opened the second half even before the "official" alert went out, at the same prices:

Those members follow our recommendation of "learn the strategies and make them your own". They are able now to be much more independent and act based on our discussion topics, without waiting for the "official" alerts.

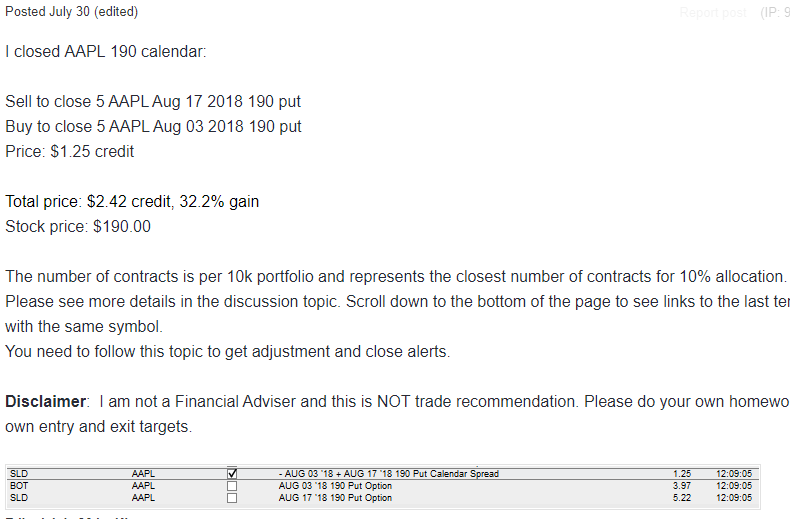

On July 30 (one day before earnings) I closed the first half of the trade:

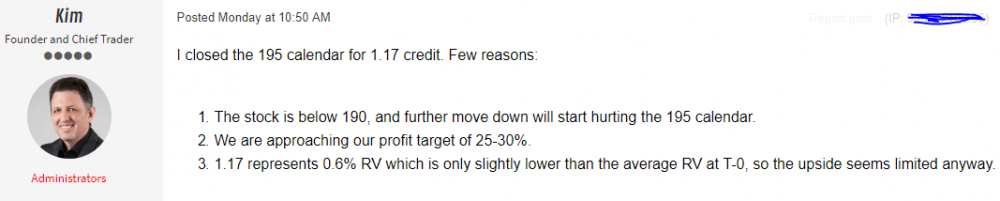

And explained the reasoning on the discussion topic:

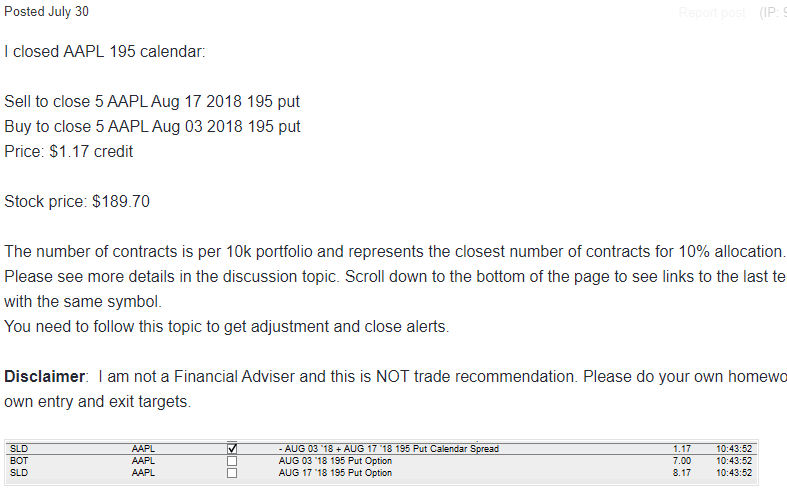

And few hours later closed the second half as well:

How other members did with this trade?

I hope this trade provided some insights into our trading process, community collaboration etc.

Some people ask us what is our "secret sauce". The answer is: there is no "secret sauce". There are NO secret strategies. It's just hard work, a lot of discipline, risk management and backtesting. This is our "secret sauce".

And of course in our case, it is an incredible value of our trading community.

Want to learn more? Start your Free Trial

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable reversal signals. Finding these lets you time your entry and exit expertly, if you only know how to interpret the signs and pay attention to the trendlines. One such signal is a combination of modified Bollinger Bands and a crossover signal.

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: