.thumb.jpg.e546dc8c605a0ba25fc81b9566c2f7e3.jpg)

Harry Browne popularized the concept of the "Permanent Portfolio" decades ago by recommending an asset allocation of 25% stocks, 25% bonds, 25% gold, and 25% cash. In the 90's, the concept of "risk parity" also became popular with writings by Cliff Asness of AQR Capital.

Read more in Why Not 100% Equities and Bridgewater's "All Weather" Fund. Both are similar concepts attempting to create a more balanced portfolio that is better prepared to handle different economic environments by investing less in stocks and more in everything else.

Options can be used in portfolios in many different ways, including to create leverage, which is one of the key tenets of risk parity. Active retail traders with margin accounts could fairly easily use the concepts in this article to create diversified portfolios with strong expected Sharpe Ratios by short selling puts on a small handful of ETF options in a sensible

WE RECOMMEND THE VIDEO: Binary options trading .How to trade on IQoptions.Best winning strategy

Binary options trading iq options Trading iq options Binary options Forex trading Digital marketing stock market How to win every trade on binary options how to ...

way (i.e. cash secured, or modestly levered in a disciplined and repeatable manner).

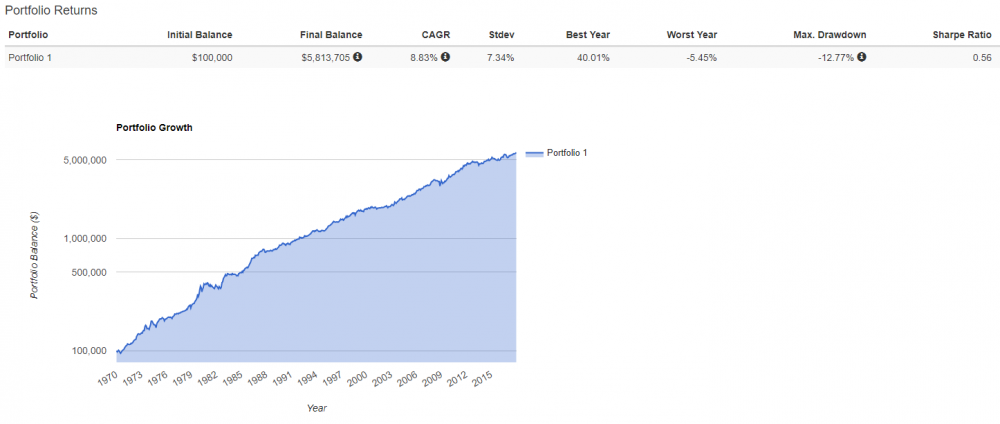

Let's first look at the Permanent Portfolio, from 1970-2017, represented by the S&P 500 for stocks (SPY when available), long term US treasuries for bonds (TLT when available), London gold price index for gold (GLD when available), and 1 month US T-bills for cash. The portfolio is rebalanced annually. We are using the excellent website, Portfolio Visualizer (www.portfoliovisualizer.com), for our examples.

Click on all images for greater clarity

Past performance doesn't guarantee future results

What is noticeable, and desirable, about the Permanent Portfolio asset allocation is the relatively steady long term historical performance with modest and relatively short lived drawdowns. It has been a stable performer due to the low correlations between stocks, bonds, and gold. But this also means the annual returns can vary substantially from stocks alone, which can be behaviorally challenging for some investors. Know thyself before making investment decisions.

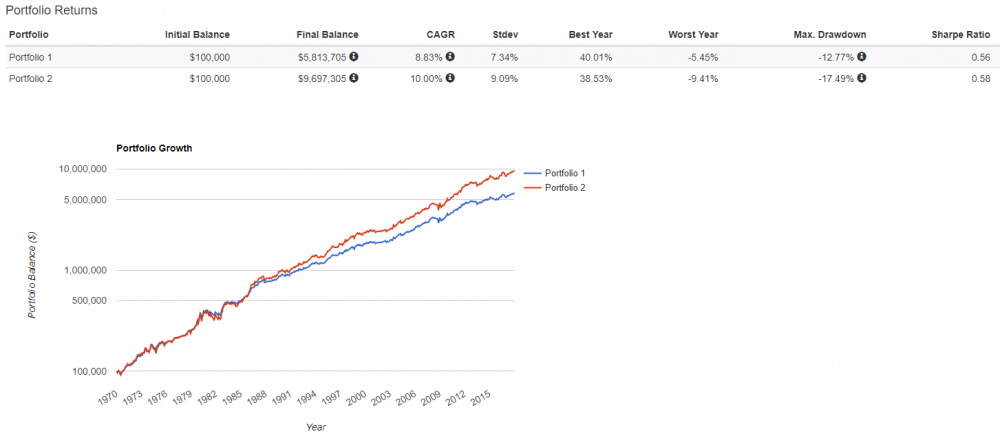

By removing cash, portfolio visualizer will allow us to solve for risk parity of our three remaining asset classes. Since 1970, this would have been an allocation of approximately 42% treasury bonds, 33% stocks, and 25% gold. By eliminating cash in the portfolio, we would expect higher returns, but also modestly higher risk, which is in fact what would have happened.

Portfolio 1: Our original Permanent Portfolio asset allocation

Portfolio 2: Risk parity weighted allocation (holdings are balanced based on risk instead of dollars)

Past performance doesn't guarantee future results

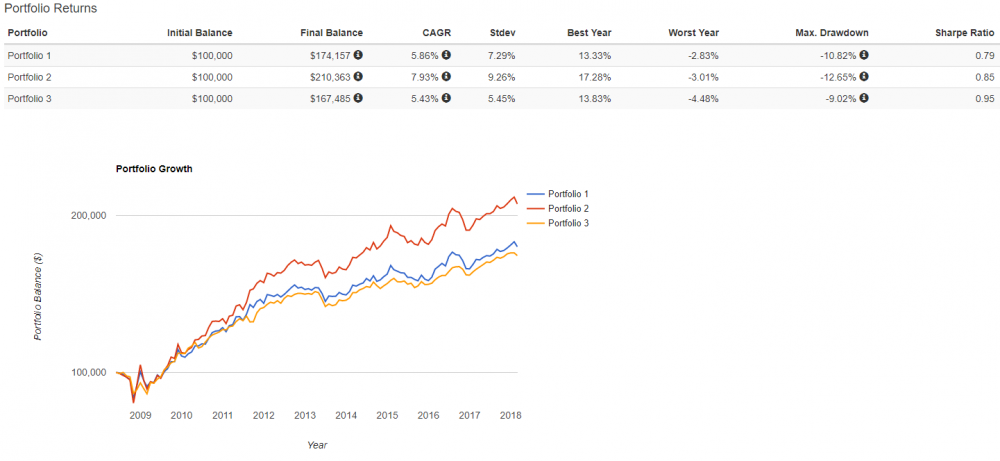

Using the ORATS "Wheel" backtester, we can backtest a Permanent Risk Parity Portfolio of 30 day short puts on SPY, GLD, and TLT since June 2008, while also adding the T-bill return to the portfolio since short puts simply require a good faith margin requirement by the broker instead of a cash outlay when holding the underlying ETF.

Portfolio 1: Permanent Portfolio

Portfolio 2: Risk Parity Permanent Portfolio

Portfolio 3: Risk Parity Put Permanent Portfolio (cash secured, i.e., no leverage)

Estimated transaction costs of slippage and commissions are built into all ORATS Wheel backtests, therefore they have been accounted for in the put parity portfolio simulation, while portfolio 1 and 2 are gross of estimated transaction costs. None of the portfolios have accounted for the impact of taxes, which have differing impacts on investors. Consult with your tax advisor. Past performance doesn't guarantee future results.

Af first glance, it may appear that selling puts in place of holding the underlying ETF is unattractive. We'd argue that investors should think about portfolios in terms of both total returns and risk-adjusted returns, and the put parity portfolio produces the highest Sharpe Ratio. Since short puts can be levered to create a higher notional exposure in a margin approved brokerage account, investors seeking higher returns could apply a modest amount of leverage to create notional exposure around 150% to produce returns in line with the underlying ETF portfolio, while still maintaining the advantage of lower volatility.

Of course, investors could also lever an ETF portfolio by borrowing in their brokerage account, but typically at a much higher cost than the implied financing rate built into derivative contracts like options. Investors comfortable with the volatility of a 100% equity portfolio (15-20% annualized) could further lever positions to have the potential for equity like returns while still maintaining the attractive diversification characteristics of a Permanent Portfolio style asset allocation mix.

It should also be noted that if an investor prefers an option position that acts more like synthetic stock (ETF), an option "combo" or "risk reversal" position can be created by combining a short put and long call. All of these concepts can be tested with the ORATS wheel, which we encourage those interested to check out as it's a great tool for automated backtesting of many option strategies with around a decade of clean historical data on many equity option symbols.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP . He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ . Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse oversees the LC Diversified forum and contributes to the Steady Condors newsletter.

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable reversal signals. Finding these lets you time your entry and exit expertly, if you only know how to interpret the signs and pay attention to the trendlines. One such signal is a combination of modified Bollinger Bands and a crossover signal.

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: