Selecting the right broker is one of the most important things for options traders. It becomes even more important if you are an active trader and trade hundreds or thousands contracts every month. Select the wrong broker - and your chances to make money are going down dramatically.

I would like to share some parameters of selecting the right broker, based on my personal experience and feedback from our trading community. You can also read our extensive Brokers and commissions discussion on our forum.

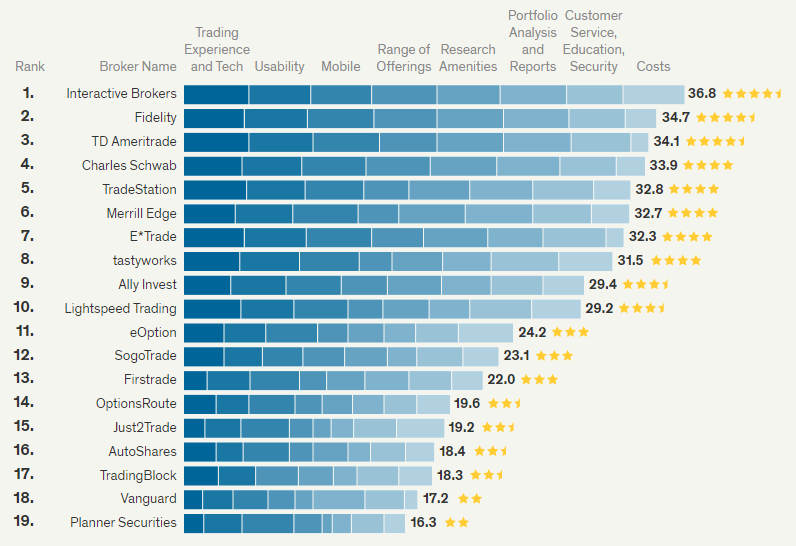

First, lets take a look at excellent Brokers Review published by Barrons. They do it every year, and it's worth to review the results and to read the brokers description.

WE RECOMMEND THE VIDEO: Why You Will LOSE Trading Options | Options Position Sizing Explained

Learn the real way to trade options with our free guide: ***i screwed up the apple example a bit because i guess i can't read.

In 2018, Interactive Brokers takes the top spot, dominating in range of offerings, portfolio analysis and reports, and costs categories.

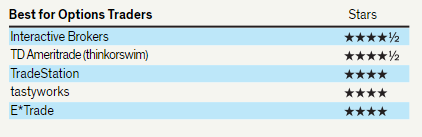

What is more important for us as options traders is the "Best for Options Traders" category. Interactive Brokers is #1 in this category as well.

What makes IB the best overall broker?

You can read the Barrons article for details, but let me share my personal opinion.

I believe that there are three most important factors when selecting the options broker:

Lets assume that you buy a straddle for $2 ($1 each option). With IB you will pay 0.70 per contract. To do a round trip trade is $2.80. This is 1.4% of the cost of the trade. So if my gain is 10%, then I keep 8.6% after commissions.

If you pay $1.5 per contract, then your total cost is $6. That's 3%. You need 3% gain just to break even.

Over time, this is HUGE. Commissions are probably the single most important factor if you are an active trader.

Some brokers also charge a fee per ticket. This is an account killer, especially for smaller accounts. If your broker charges a ticket fee, you need to change bro kers immediately.

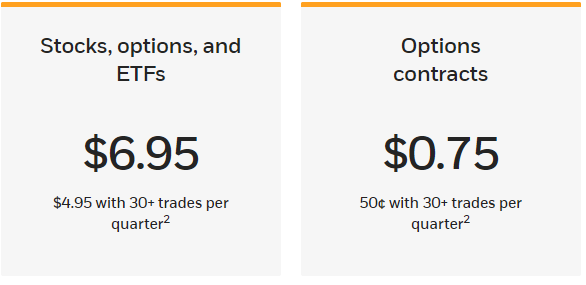

Here is an example from Etrade:

Just to be clear, you will be paying $6.95 PER TRADE ($4.95 for more active traders) In addition to per contract fee. So if you trade for example one straddle, it will cost you (as an active trader) $11.90 for a round trip trade, compared to

TD Ameritrade is even worse:

I'm sorry, but this is a robbery. Those brokers simply don't deserve your business.

IB used to be the cheapest broker, but there are few other excellent options today in terms of cost.

SteadyOptions members might consider Tradier Brokerage Special Offer. Tradier offers a special $40/Month of Flat Price Trading for SteadyOptions Clients. For $40/mon th the SteadyOptions client can trade unlimited options trades and there will be no per trade commissions. Please review the link for details.

eOption also offers a special rate of $1.99 per options trade (or equity trade) plus 10₵ per options contract.to our members. Please see eOption Brokerage Special Offer for more details.

tastyworks is also an excellent option, especially for larger accounts. They charge $1.00 per contract for opening trades, $0.00 for closing trades (so just slightly cheaper than IB), but they also capped the commissions to $10 per leg. For larger accounts, this means huge savings.

Execution

What's the point to have low commissions if your execution sucks?

Well, IB has one of the best executions in the industry, thanks to its "Smart Routing":

- Unlike smart routers from other online brokers, IB SmartRouting never routes and forgets about your order. It continuously evaluates fast changing market conditions and dynamically re-routes all or parts of your order seeking to achieve optimal execution and maximize your rebate.

- IB SmartRouting represents each leg of a spread order independently and submits each leg at the best possible venue.

From my experience, and based on members feedback, this algorithm does indeed provide an advantage compared to most other brokers. However, members who used Tradier and tastyworks also reported pretty good results.

Platform

Having a good and intuitive platform is the third factor that you should consider.

It should be stable, intuitive and offer fast way to place trades. IB platform requires some learning curve, and some users consider it outdated, but personally, I like it. I might be biased as I have been using for over 10 years now, but I believe the learning curve is well worth it.

Many users praise TD Ameritrade (thinkorswim) platform for its expensive features, but their current commissions structure makes it terrible for active options traders. Unless you were grandfathered at their older rates, or can negotiate commissions under $1.00/contract with no ticket fee, I would avoid them.

Other Considerations

There are some other things that you should consider, such as:

- How is the Customer service? Unfortunately, IB has one of the worst customer services in the industry. Don't expect any hand holding, and don't expect any help in case you have some trading issue. Their philosophy is "our algorithm is always right, obviously you (the customer) did something wrong."

- Does the broker charge extra for real time data and how much?

- How about assignment fee and exercise fee? IB charges ZERO for both, while some other brokers charge $15-20.

- What are the margin rates? IB has the lowest margin rates in the industry.

- What happens in case of margin call? IB has the strictest rules regarding margin rules. When you get a margin call (in case of assignment for example), they might liquidate your positions within minutes. It's an automated process, nothing you can do about it, so try not to get a margin call with IB.

- What about Global Markets? IB is rated #1 by Stockbrokers.com in the Best for International Traders category. It offers very wide range of international markets and products, and also accepts clients from all around the Globe. Many other brokers have limited exposure in terms of countries they accept clients from.

Conclusion

In this article, I tried to offer some personal perspective on selecting an options broker. In my opinion, Interactive Brokers, tastyworks and Tradier offer the best combination of cost, execution and platform.

That doesn't mean there are no other good brokers. This conclusion is based on my personal experience and feedback from hundreds of members.

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable reversal signals. Finding these lets you time your entry and exit expertly, if you only know how to interpret the signs and pay attention to the trendlines. One such signal is a combination of modified Bollinger Bands and a crossover signal.

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: