Please note: As required by the European Securities and Markets Authority (ESMA), binary and digital options trading is only available to clients qualified as professional clients.

The KDJ is an indicator designed for the sole purpose of making trading as effective as possible, and it undoubtedly deserves your attention. The KDJ is perfect in determining both the trend and the optimal entry points.

WE RECOMMEND THE VIDEO: Hirose Binary Options

To those of you who already know basic technical analysis tools, the KDJ might look similar to the Alligator or the Stochastic Oscillator. Just like these two tools, it allows you to determine the direction and strength of the trend and the optimal entry points.

It is worth noting that, like any other indicator that follows the trend, The KDJ provides many false signals at times when the market is flat. For this reason, many traders consider it appropriate to use it over prolonged time intervals.

How does it work?

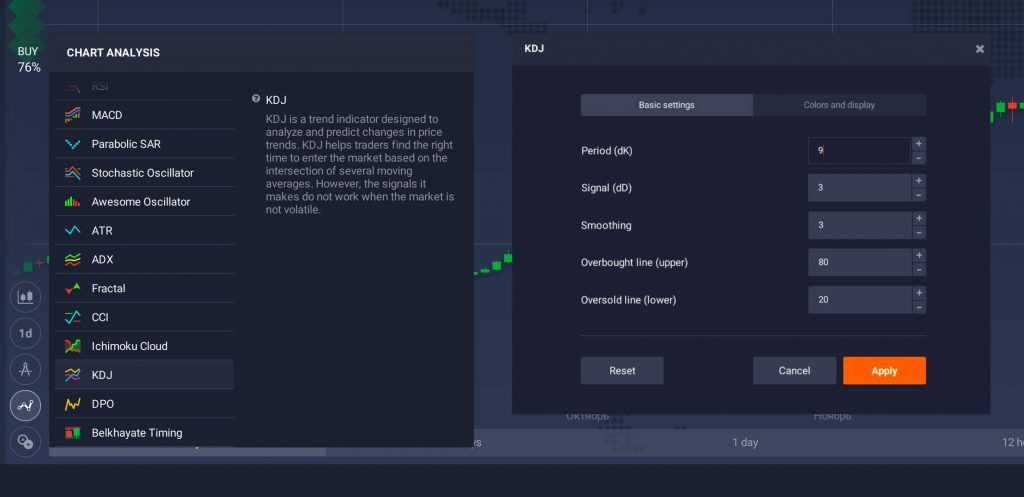

The KDJ consists of three lines (K, D and J, which give the name to the indicator) and of two levels. The K and D lines are the same as those displayed when using the Stochastic Oscillator. The J line, on the other hand, represents the divergence of the value D from the value K. The convergence of these lines suggests a trading opportunity.

The crossovers of the three lines can be interpreted as signals of purchase and sale

The crossovers of the three lines can be interpreted as signals of purchase and sale

As in the Stochastic Oscillator, the overbought and oversold levels correspond to times when the trend could be reversed. By default, the levels are set to 20% and 80%. Both can be adjusted to achieve greater sensitivity or fewer false signals.

How to use it?

You can set the indicator in three simple steps:

- Go to "Indicators" (bottom left on the screen);

- Select the KDJ from the list of available indicators;

- Click Apply without changing the values.

The indicator is ready to be used! Which signals do you need? There are two types of signals that you can receive from the KDJ. When the three lines converge above the overbought level, with the blue line above the yellow and the yellow above the purple, it is advisable to sell the asset. And viceversa. When lines converge below the overbought level, with the purple line above the yellow line and the latter above the purple line, it may be the case buy the asset.

Aspects to consider

For best results, the KDJ can be combined with other indicators, such as the average directional index (ADX) and the average real interval (ATR). The first one is always before the curve and can suggest a next inversion of the trend. The last one is able to determine the volatility of the market, which is particularly useful since the KDJ does not work during the flat market periods.

Remember that there is no indicator capable of providing 100% accurate signals. Even the best indicators fail from time to time, leading to negative operations. Regardless of the indicators you entrust yourself with, do not forget to follow the basic rules of risk management and of the funds to be invested.

This article does not represent an investment advice. Any reference to past movements or price levels is informative and based on external analyzes, we do not provide any guarantee that such movements or levels may reoccur in the future. In accordance with the requirements set by the European Securities and Markets Authority (ESMA), trading with binary and digital options is only available to customers categorized as professional clients.

GENERAL INFORMATION ON RISKS:

CFDs are complex instruments and carry the high risk of losing money quickly due to the leverage effect. 76% of retail investor accounts lose money when trading with CFD through this provider. You should make sure you understand how CFDs work and if you can afford to take the high risk of losing your money.

Source: IQOption blog 2018-11-13 11:49:04

* This is redirection to the official website where you can sign up to IQ Option broker

Wednesday, August 5, 2020