Please note: As required by the European Securities and Markets Authority (ESMA), binary and digital options trading is only available to clients qualified as professional clients.

As you probably already know, there is no single "best" indicator of technical analysis. Each of them is right for a given moment and for a given place. However, if they had to choose their favorite tools, many traders would answer "the MACD". The moving average convergence divergence is a trend tracking indicator that is used to identify an emerging trend, both upwards and downwards. It is one of the most effective and absolutely used technical analysis tools. In today's article we will look more closely at the indicator and learn to apply it in trading.

WE RECOMMEND THE VIDEO: WHAT NOT TO DO WITH OPTIONS | Option Trading For Beginners

Channel For Crazy Robinhood Trades + Wall Street Bets [Second Channel For Stock News]: ...

What is MACD?

The moving average convergence divergence will help you identify emerging trends, probably the most important aspect in any successful trading venture. However, like any other indicator, the MACD must be used correctly in order to offer tangible results. It is therefore necessary to understand what is in your hands.

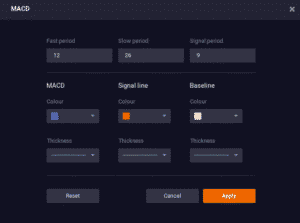

In simple terms, the MACD is a combination of two lines: the slow moving average (orange) and the fast moving average (blue). The difference between the two is shown by the red and orange bars – hence the terms "divergence" and "convergence" in the name of the indicator. By default, the fast moving average is calculated on the basis of 12 periods, while the slow moving average uses 26.

How to use it in trading?

MACD is a complex tool that can be used in various ways:

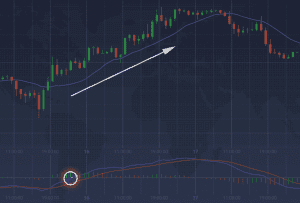

First you can search for the point where the two moving averages intersect. When the fast moving average rises above the slow, an upward trend is likely to form. Conversely, when the fast moving average falls below the slow one, a downward trend may occur. This is the most common way in which the MACD is used in trading.

First you can search for the point where the two moving averages intersect. When the fast moving average rises above the slow, an upward trend is likely to form. Conversely, when the fast moving average falls below the slow one, a downward trend may occur. This is the most common way in which the MACD is used in trading.

Secondly, it is important to keep an eye on the so-called crossover of the

centerline. When the fast moving average moves beyond the center line (white), the trend is likely to continue upwards. Conversely, if the fast moving average moves below the baseline, the price may fall. This is not perhaps the most common mode of use of the MACD, but it is nevertheless a useful element.

centerline. When the fast moving average moves beyond the center line (white), the trend is likely to continue upwards. Conversely, if the fast moving average moves below the baseline, the price may fall. This is not perhaps the most common mode of use of the MACD, but it is nevertheless a useful element.

Finally, it is possible to wait for something called divergence. When the price action and the MACD chart show an opposite movement, the trend may soon be reversed. An upward divergence is formed when an asset registers a lower minimum and the MACD forms a higher minimum. A downward divergence occurs when an asset registers a higher maximum and the MACD line forms a lower maximum. This is an advanced technique that requires some practice before being applied correctly. In any case, it deserves your attention.

Finally, it is possible to wait for something called divergence. When the price action and the MACD chart show an opposite movement, the trend may soon be reversed. An upward divergence is formed when an asset registers a lower minimum and the MACD forms a higher minimum. A downward divergence occurs when an asset registers a higher maximum and the MACD line forms a lower maximum. This is an advanced technique that requires some practice before being applied correctly. In any case, it deserves your attention.

Note that all indicators, regardless of their reliability, can sometimes generate false signals. It is therefore advisable to check the signals you receive and compare them with other indicators or different time frames (preferably with both).

How to set it up?

Setting up the MACD is simple. Simply follow the following steps:

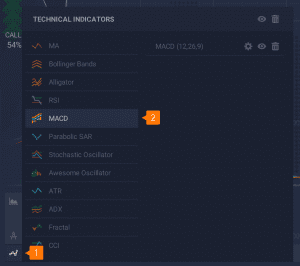

Click on the "Indicators" button in the lower right corner of the screen

Select the MACD from the list of available indicators

Without changing the settings, click "Apply"

And you're ready to start. Now that you know how to set up and use this indicator, test the MACD. Use it to increase your chances of making correct predictions.

General Risk Notice

The financial services provided by this website carry a high level of risk and can lead to the loss of all your funds. You should never invest money that you can not afford to lose

Source: IQOption blog 2018-08-01 13:37:52

* This is redirection to the official website where you can sign up to IQ Option broker

Thursday, August 13, 2020